Up next

Watch Bill Gates Laugh As He Talks About Dead Kids And World War

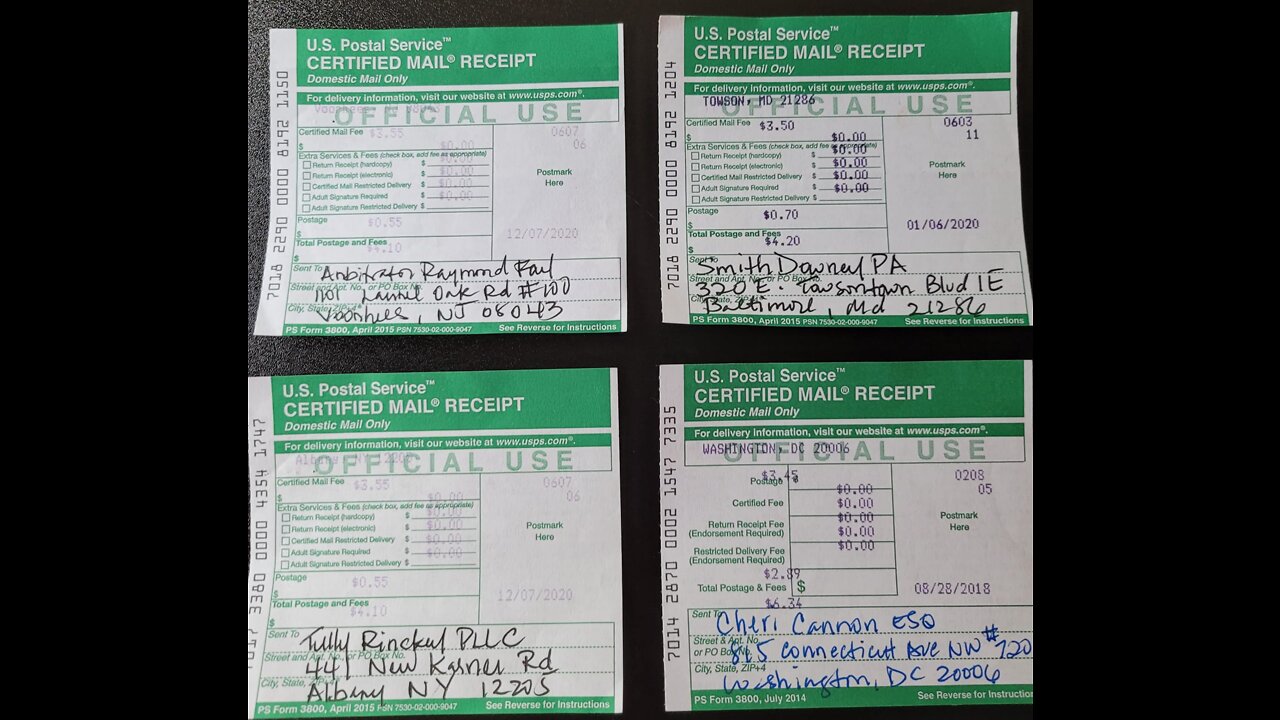

Tully Rinckey PLLC Albany New York - Better Business Complaints

General Breedlove Talks NATO Sending Tanks To Ukraine As Tensions Escalate With Russia

EXCLUSIVE: Bloomington police chief talks about fighting crime — and winning

Melissa Sue Anderson talks about her favorite TV series (2024)

Melissa Sue Anderson talks about speaking French at Monte-Carlo TV Festival (2022)

Joe Biden talks about access to abortion, women in US killed by immigrants

At Home with Pam • July 2024 Business of the Month: Modern Grace

Putin sets out Russia's conditions for peace talks with Ukraine

THIS is How the Corporate Media Discussed Biden's Mental State BEFORE the Debate...

MEO EP #255: DJ ENVY TALKS MIXTAPE ERA, DJ KAY SLAY, RELATIONSHIPS, DEFENDING CHARLAMAGNE + MORE

Surgeon General talks ‘reverberating trauma’ of gun violence

Kevin Bridges Talks Childhood Memories | A Whole Different Story | Universal Comedy

Dr Disrespect Finally Talks About It

Business Podcast | Call Center 101 | Wh You Must Relentless Call Every Inbound Lead

EU and China set for talks on planned EV tariffs | REUTERS

Cyber attacks stall business at car dealerships nationwide

Putin In North Korea Live | Putin-Kim Begin Talks As Pyongyang Rolls Out Red Carpet Welcome | N18L

Keir Starmer gets emotional as he talks about late parents to Gary Neville

“ STANDARD BUSINESS MACHINE OF THE AIR ” 1964 ROCKWELL JET COMMANDER PROMO IAI WESTWIND XD81214

Lifestyles Business Plan

Chris Crack - Standing On Business Like There's Nowhere To Sit (Official Music Video)

President Trump Talks Immigration & War WIth Tim Pool w/ Trump & Kash Patel | Timcast IRL

Putin lands in North Korea for talks with ‘Axis of Evil’ ally Kim Jong-un

MEO EP #253: GIGGS TALKS BREAKING INTO THE UK RAP SCENE, HIS JOURNEY FROM PECKHAM TO FAME + MORE

9.1 Cancel Culture is Corporate Management Culture | What is Politics?

Fani Willis talks about being ‘broke’

CTMU Discussion: Kal Rivet and Jonathan Mize on God's Time, Logic, Theology, AI and Morality

Yellen hails 'productive' talks as Beijing visit ends

Corporate Tax Morality | Zicklin Talks Business

While it’s legal to minimize taxes, some corporations push the limits of the law and pay average tax rates much lower than might seem fair. Just one example–among many–is the NJ-based pharmaceutical firm Merck, said to pay in 2021 an effective tax rate of 11%, roughly half the US average corporate tax rate of 21%. Do firms have a moral obligation to obey the spirit of the law in addition to the letter of the law? Are they bound by Delaware law that requires them to work in the interests of their owners and shareholders? Or should the tax law be modified to make it clearer that the spirit of the law is relevant and often determinative? Larry Zicklin (BBA, ’57) discusses these questions with Prof. Michael Meisler, Lecturer in the Stan Ross Department of Accountancy, and Prof. Daniel I. Halperin (BBA, ’57), Stanley S. Surrey Professor of Law, Emeritus, at Harvard Law School. With an introduction by Interim Dean Paquita Davis-Friday and a Q&A session moderated by Associate Dean Gwen Webb. Guest List Daniel I. Halperin, Stanley S. Surrey Professor of Law, Emeritus, Harvard Law School Michael Meisler, Lecturer in the Stan Ross Department of Accountancy, Zicklin School of Business Tape date: October 11, 2022. First aired: February 13, 2023. ZTBU20221011

- Top Comments

- Latest comments

![Ep. 2994a - [HRC] Pushes Climate Change Agenda, Watch Corporate Profits, Step 2 Of The Recession](https://hugh.cdn.rumble.cloud/s/fw/s8/1/E/d/A/h/EdAhi.qR4e-small-Ep.-2994a-HRC-Pushes-Climat.jpg)